PumpFun Revenue Drops 95%

Disclaimer. The analysis provided is strictly for informational purposes only and should not be regarded as financial advice. Cryptocurrency markets are volatile and unpredictable, and potential financial losses can result from investments. It is essential to consult an expert financial advisor before participating in any investment.

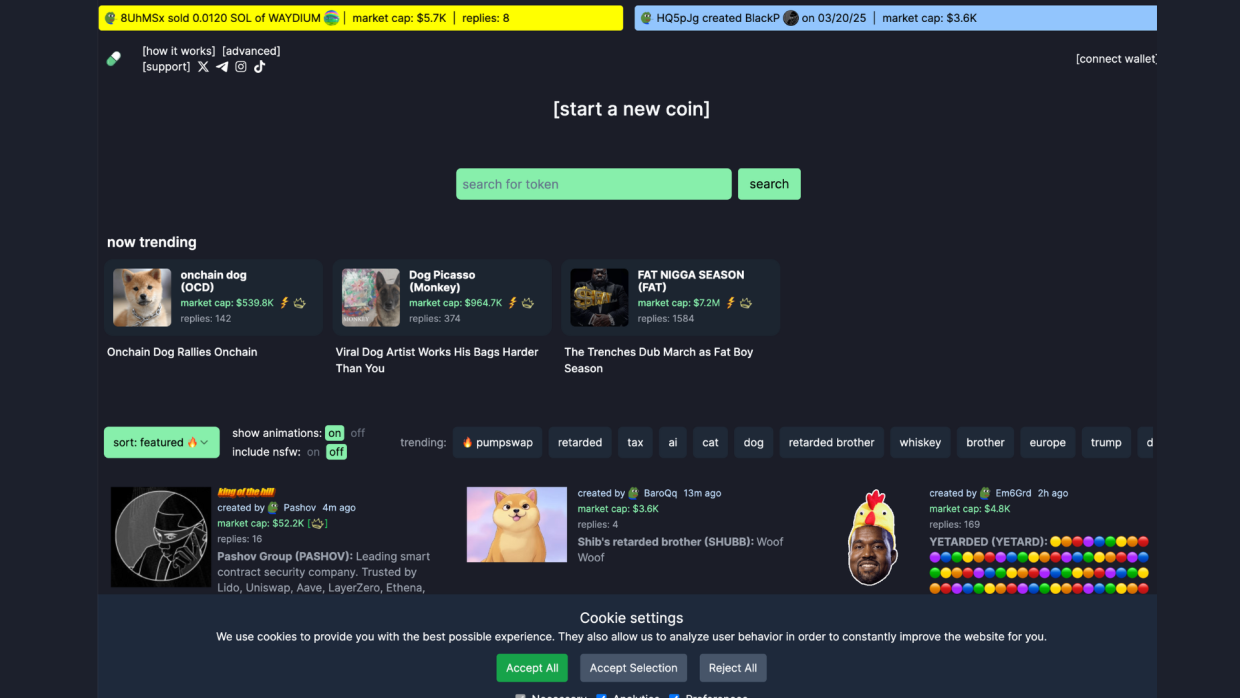

In a tragicomic twist befitting a very dark meme, PumpFun, one of the very popular Solana-based memecoin creation platforms, has seen revenue down a tremendous 95%. From free-fall high on the wings of memecoin mania, the commission revenue for the platform fell from runner's highest call of $15 million a day to something around $1 million just some weeks back. It appears that the bubble of memecoins has not just dripped but has deflated loudly with a thud.

January 2025 was, in fact, a meme dream. Solana-based PumpFun became the high production house for minting digital nonsense. During its peak, the platform was minting fees in millions daily with traders after memecoin lotteries. Be it coins named after frogs, farts, or ex-presidents, the memecoin hype on PumpFun made the blue-chip asset Bitcoin look as serious as a dad joke.

Trading volumes looked like a rocket ship—one where you would put on the sticker "To the Moon!"—the platform earning 12,000 SOL every day, roughly $15 million in current value. PumpFun was not just another profit earner; it was the sole hero of Solana's DeFi universe, responsible at one point for over 70% of all token launches on the network.

Then, come March; it seems that the conveyor belt of the memecoin factory has stopped working. Daily revenue thinly down to a scanty 1,000 SOL or about $1 million—finding out that the Meme King has lost his crown. The complete demise of memecoins' import over Solana was hardly surprising, as the euphoric market that was once the so-called "crypto" world went ahead and exhausted itself into passive despondency.

Disclaimer. The analysis provided is strictly for informational purposes only and should not be regarded as financial advice. Cryptocurrency markets are volatile and unpredictable, and potential financial losses can result from investments. It is essential to consult an expert financial advisor before participating in any investment.

What caused the sudden crash? An analyst concoction of fatigue from memecoins, saturation in supply-demand, and altitude lost from speculative capital markets appear to be some plausible reasons. Investors have shied away from making merry about promises of making it, and trading volumes and graduations to tokens are in freefall. Certainly, people are coming to know that fun is priceless, and meme tokens mostly are not worth the trouble.

To many, meme-coin markets were somewhat like a parody saying, “Who needs utility when you have humor?” Yet the same frenzy that minted fortunes has opened gates to utter chaos, scams too, and notorious pump-and-dump schemes. Anyone remember the Libra and Trump’s memecoins? Crude stories, meteoric rises, and equally swift crashes just made the whole darker canvas of the ecosystem at the very edge.

Practically speaking, realms of math speak loudly against sustainability: Almost 98.5% of PumpFun tokens never see the light of day in larger exchanges, meaning it might be easier to spot Waldo than find a successful memecoin today.

A 95% revenue drop for PumpFun is not just one bad meme-it is a cartoonish caricature of correction in crypto markets. There still might be some seduction for Solana, courtesy of fast and cheap development, but very few believe that memecoins will be the ones kick-starting up the growth here. Whether memecoins will ever develop into something beyond speculative comic relief is left to be seen.

For now, I believe the rides may shortly go down at PumpFun's memecoin amusement park. But don't worry—if you've survived the last chapter of the memecoin saga: your portfolio might be down, but your sense of humor most definitely isn't!...