$GHIBLI Loses Steam: Meme Coin Fades as AI Hype Cools and Holders Rush to Sell

After its explosive rise powered by AI-generated art and viral trends, the memecoin $GHIBLI is now in decline. Initially driven by the popularity of Studio Ghibli-style AI images and the broader memecoin boom, the token has lost momentum. As the price continues to drop and investor hype fades, many are beginning to question whether $GHIBLI has already peaked – or if it ever had a long-term future.

$GHIBLI is a meme coin inspired by the distinctive animation style of Hayao Miyazaki and Studio Ghibli, known globally for beloved films like Spirited Away and My Neighbor Totoro. The coin emerged at the height of an AI-powered trend that allowed users to transform images into Ghibli-style artworks using tools like DALL·E within OpenAI’s GPT-4o.

The trend gained traction when OpenAI CEO Sam Altman changed his social media profile picture to a Ghibli-style portrait, which many saw as a cultural signal merging tech and nostalgia. Although the coin has no formal connection to Studio Ghibli, it quickly caught the attention of meme traders, social media influencers, and speculators drawn more by meme potential than by actual use case or utility.

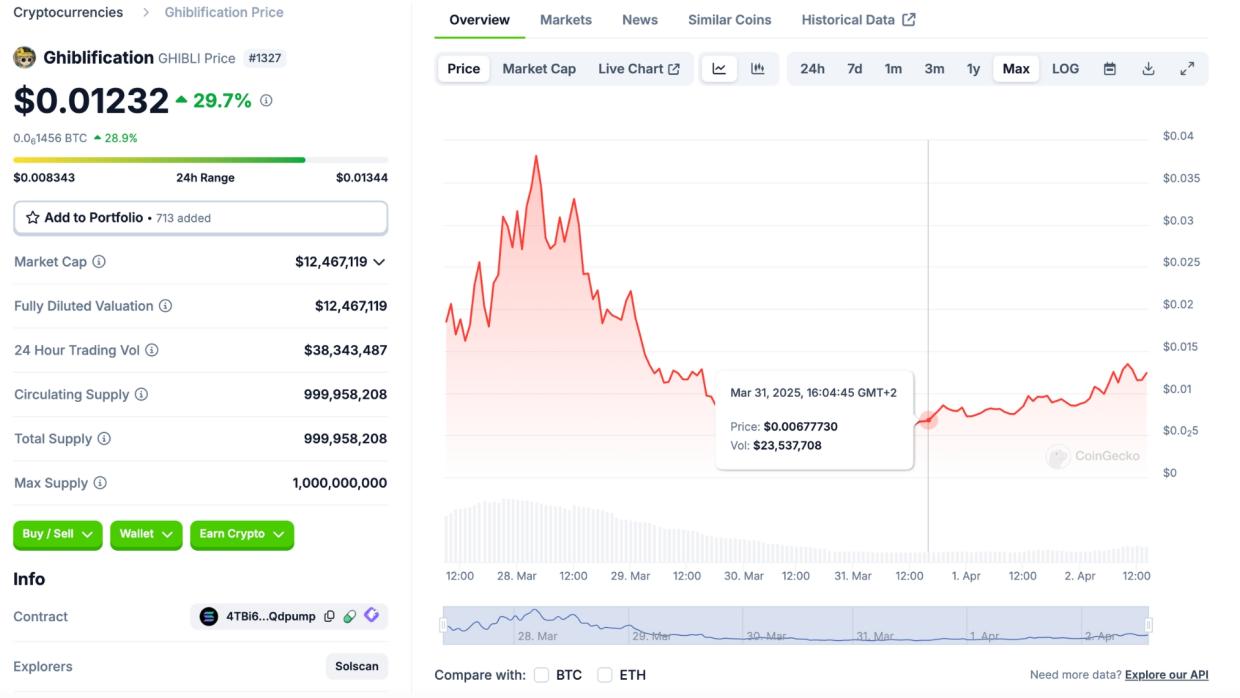

The largest $GHIBLI token on the Solana network launched on March 26, 2025. At its height, it surged to $0.028, giving it a market cap of over $20 million. A second version of the token appeared on Four.meme, using a Ghibli-style image of Binance founder CZ as its symbol. That version peaked at a price of 0.000004, reaching $8 million in market cap in less than a day.

However, these rapid gains didn’t last. Within 24 hours, the original token dropped below $0.02 and continued falling. Trading volume thinned out, and the usual social media promotion on platforms like X and Telegram nearly disappeared. Reports began surfacing that large holders were selling off their stakes. Without new momentum from influencers or events, the token is now struggling to maintain relevance.

The downturn has been worsened by market saturation. Multiple $GHIBLI-named tokens launched simultaneously, creating confusion and diluting community interest. Meanwhile, the novelty of AI-generated Ghibli-style art has started to wear off. Even the irony of using AI to mimic the work of Miyazaki – a known critic of artificial intelligence – no longer carries the same appeal.

The fall of $GHIBLI serves as a reminder of how quickly meme coin narratives can change. While the token benefited from the right mix of pop culture, AI tools, and online buzz, it lacked a foundation to support lasting value. If social engagement doesn’t pick up again, the coin may fade into obscurity within weeks.

There is still a chance of short-term volatility. Meme coins often see brief revivals when whales or influencers re-enter. But without a clear narrative or new community interest, $GHIBLI is likely to be remembered as a passing trend rather than a serious project in the meme coin space.

The rise and fall of $GHIBLI highlight the speed and unpredictability of the memecoin market. What begins as a viral phenomenon can just as quickly turn into a widespread sell-off. Investors should approach such tokens with caution, distinguishing between temporary hype and real staying power. As always, solid research and a steady hand are essential when engaging with high-risk assets like meme coins.