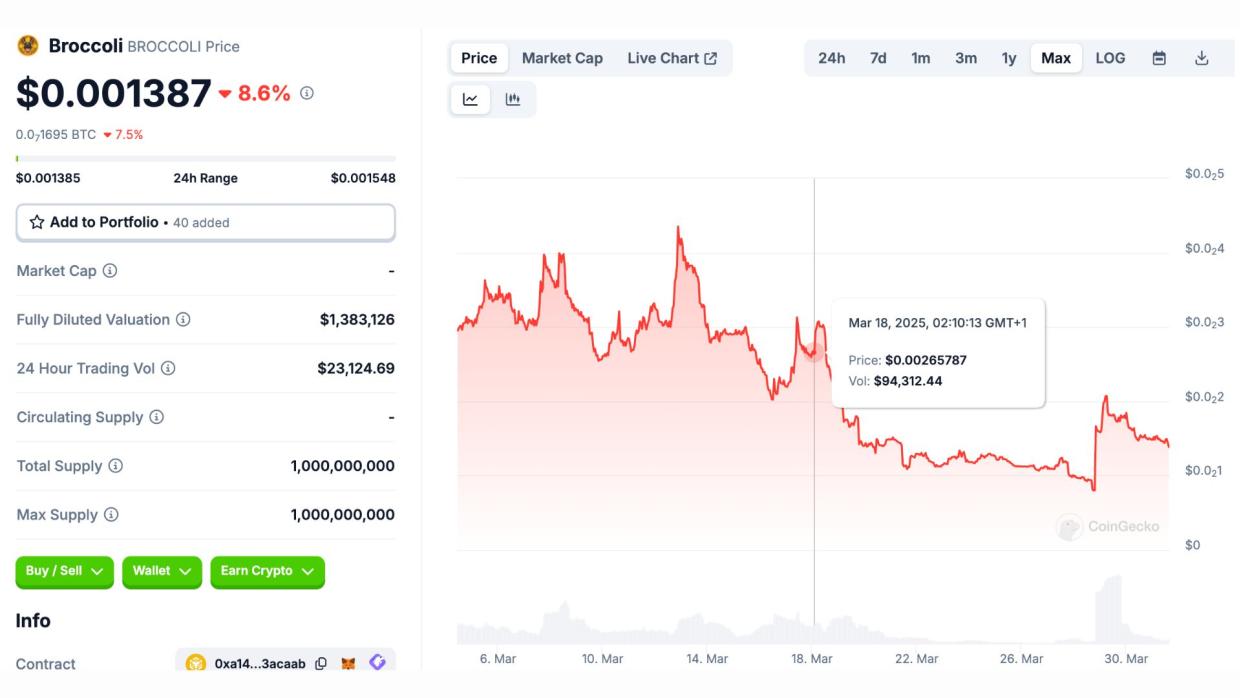

$BROCCOLI went down after listing

Saga of $BROCCOLI may be counted amongst the less fortunate tales of the cryptocurrency age. Despite much hype surrounding its introduction, $BROCCOLI performed lukewarm—actually, this vegetable-themed cryptocurrency fell faster than one could say the words "pump-and-dump."

This article is not intended to be an investment recommendation. And not in any form whatsoever!

Early momentum was driven by aggressive marketing campaigns and social hype, and $BROCCOLI saw a short-lived spike, with a respectable high of $0.088. But the high point was short-lived. In the aftermath, the token suffered a 48% dump, leaving early investors wondering if they had bought the next memecoin sensation or just a hype-driven fad with no underlying substance. Let's dive into the news!

A properly prepared salad requires balance, and BROCCOLI seemed to be bent on speculative dressing rather than practical usage. In terms of the lingo, the token's steep fall can be attributed to a combination of profit-taking action on the part of early investors, panic selling by retail players, and a bit of "post-shilling syndrome" that was described by some traders. The shilling initially gave the sense of optimism, but it ultimately proved to be harmful for the wider market.

As the market moves toward maturity, the players on the trading front have been more conservative with zero-utility tokens similar to $BROCCOLI! It is literally the salad bar experience, said one of the a memecoin specialist on X (once known as Twitter). So, here’s the quote:

"You think you're buying fresh greens, but at the end of the day, all you're with is soggy greens and despair."

The present price of $BROCCOLI is still strong at the $0.048 level, showing no inclination of breaking free from the dominant downtrend. There is a lot of speculation about the possibility of further fall, with comparisons being drawn with the courses of several other memecoins, which saw short-lived but sharp spikes. Even though some analysts see the possibility of future stabilisation, the general consensus suggests that $BROCCOLI is poised on the brink of obsolescence following a unique negative incident.

Interestingly, the token’s steep decline also casts a shadow over its broader ambitions. Market observers had initially hoped $BROCCOLI would carve out a niche within the DeFi ecosystem, but the recent slump raises concerns over its ability to sustain investor interest amidst fierce competition and dwindling hype.

The BROCCOLI saga is a cautionary tale of volatility! Even as these crypto currencies offer a tempting potential for instant wealth from their meme-driven start and surrounding meme culture, these currencies carry inherent risks that often leave retail investors with little to no returns—more extreme cases even seeing investors with assets of no value.

This article is not intended to be an investment recommendation. And not in any form whatsoever!

The realm of memecoins is known for its volatility, with their rapid amassing and then losing value based on the flimsiest of stories, often involving animals, vegetables, or sometimes even inorganic objects. For $BROCCOLI, the story might not be ending anytime soon currently; however, its current path shows high chances of it eventually being avoided by our good friend a stale salad.

For those thinking about the possible revival of $BROCCOLI, one of the oldest tenets of trading is still relevant: "Do your own research." And the difference between fun and pressure is often delicate, most commonly exemplified by a price chart with large swings.

And again — this article is not intended to be an investment recommendation. And not in any form whatsoever!

Let’s hope $BROCCOLI finds its way back to the greener side of crypto farming—or at least inspires a tastier meme in the process. In the meantime, whether you’re a buyer or a bag holder, it’s clear: $BROCCOLI is not for the faint of wallet.