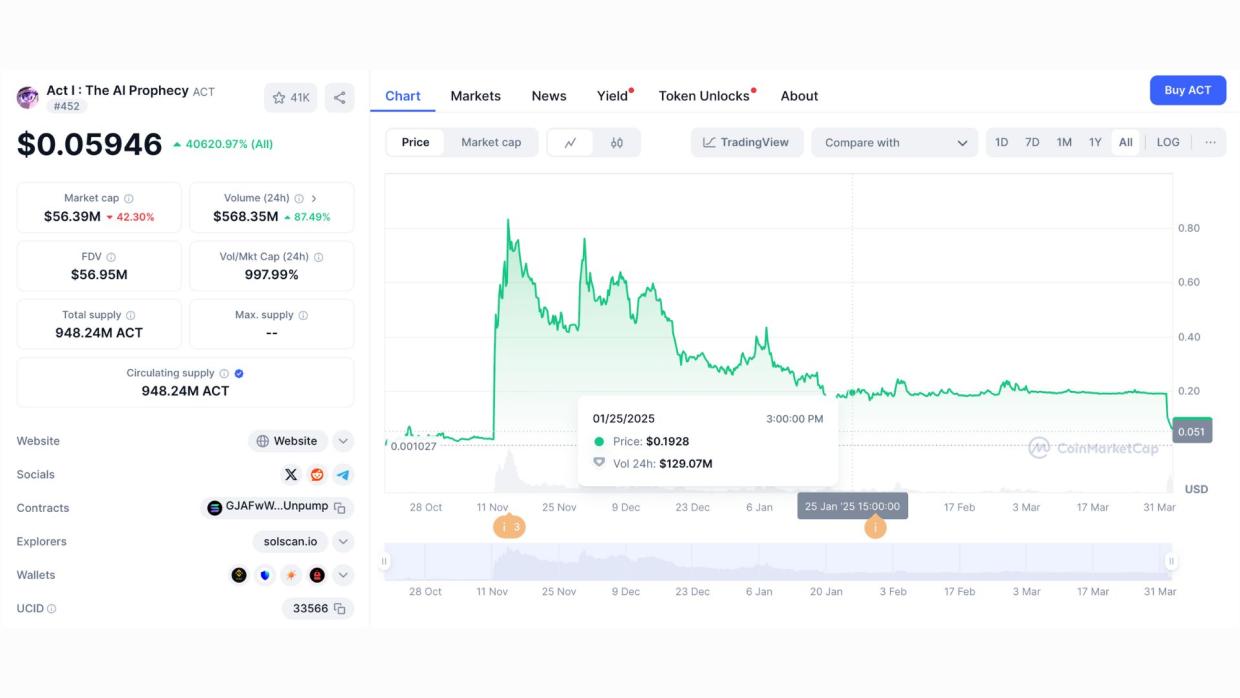

$ACT Token Drops Nearly 30% After Large Sell-Off by Binance VIPs

That the price of low-cap meme token $ACT suddenly and sharply dropped on Binance’s spot exchange. The price fell following three VIP users and one non-VIP user offloading over $1 million worth of tokens altogether. When trading volumes reduced and prices declined, Binance made an official announcement detailing the events of the event.

ACT (which is often stylized as фACT or ACT) is one of the memecoins that hit the headlines because of its viral branding and meteoric growth among the communities of trading low-cap tokens. Like all meme tokens, it does not offer utility as such but thrives and perishes on social media buzz, hype, and trading among enthusiasts. Despite being listed on mid-grade exchanges and having a loyal niche following, its liquidity and depth of the market were always limited.

Prior to the collapse, ACT had garnered moderate popularity among retail traders who were keen to capitalize on transient price volatility. Social media hype and inclusion on various small-cap memecoin watchlists made the token popular. Similar to most tokens of its type, however, it was highly volatile and reactive to sudden shifts in sentiment and enormous market orders.

Three VIP users, according to Binance’s announcement, sold around 514,000 USDT worth of $ACT tokens within a short window on the spot market. Around the same time, one non-VIP user transferred an enormous volume of ACT from another exchange and sold tokens worth around 540,000 USDT. The combined sell pressure made the price drop sharply, and $ACT lost nearly 29% of its value within hours.

This sudden drop also triggered some leveraged positions to be unwound on the ACT/USDT perpetual futures market. When the price of ACT fell, lower market cap tokens were affected by contagion, and the drops spilled over to comparable assets. Binance confirmed that it did not notice any single account profiting handsomely from the event.

Significantly, Binance made it clear that ACT tokens are fully circulating on the secondary market. In this regard, the exchange does not have control over personal sales, especially when they are triggered from off-platform wallets. Nevertheless, Binance assured users that it is continuing to dig deeper and will provide updates as soon as there are any new findings.

Binance made the leverage adjustment on its ACTUSDT perpetual contract as a response to volatility. No market irregularities or forced liquidations were reported during the adjustment.

This incident shows the susceptibility of low-liquidity tokens to large or collusive sell orders. That four users managed to push the price so much is indicative of the need to manage risks when trading in volatile markets. Binance’s leverage change decision shows that the exchange is monitoring such events closely, but for traders, the risks are there.

At this stage, the destiny of $ACT is uncertain. Unless optimism returns soon, the token might not recover. Market makers would step up and support it, but retail demand would collapse unless there is any change of events or momentum.

The April 1 collapse of the price of the $ACT was triggered by heavy selling by a group of users, and this exposed vulnerabilities of thin trades of memecoins. Despite Binance responding by making adjustments and being transparent, the event serves as a reminder that investments in meme tokens are risky. As ever, traders are reminded to exercise caution and be mindful of the liquidity and volatility of the assets they hold.